Business registration in Hong Kong

in 1 day from 990 $

Open free business bank account and Visa card online from our partner Neobank in Hong Kong

Direct service from a licensed registrar saves up to 50% of your budget and ensures full compliance with the Hong Kong Companies Ordinance

How We Register Your Company in Hong Kong — Step by Step

- Name Check

We verify your chosen company name against the Companies Registry database to ensure it’s unique and compliant with the Companies Ordinance (Cap. 622)—avoiding rejection and fee loss - Document Prep & KYC

We collect and validate all required documents, ensure forms meet regulatory standards, conduct a mandatory identification of significant controllers, and certify the identity documents - Company Incorporation

We submit the completed NNC1 form and Articles of Association to the Companies Registry, pay the government fee, and initiate automatic data sharing with the Inland Revenue Department (IRD) - Business Registration

Your Business Registration Certificate (BRC) is issued by the IRD, confirming your company’s legal right to operate in Hong Kong

- Certificate of Incorporation (issued by CR)

- Incorporation Form NNC1 (issued by CR)

- Articles of Association (approved by CR)

- Business Registration Certificate (issued by IRD)

- First Shareholder Resolution

- Director’s Consent to take the position

- Share Certificate(s)

We receive all official correspondence addressed to your company from Hong Kong government authorities, including notices from the Companies Registry, Inland RevenueDepartment, and other regulatory bodies.

Upon receipt, we promptly notify your company’s authorized representatives by sending secure, scanned copies of all documents and notifications — ensuring you stay informed and can respond in a timely manner

Compliance with Hong Kong Law: Corporate Secretary Requirement

Under Section 475(1) of the Companies Ordinance (Cap. 622), every private company incorporated in Hong Kong must appoint a qualified Corporate Secretary

All our incorporation packages include 12 months of licensed Corporate Secretary services, provided under a formal service agreement. This ensures your company remains in full, lawful compliance with Hong Kong statutory requirements—transparently, officially, and with no hidden fees

Provision of a compliant registered office address in Tsim Sha Tsui — Hong Kong’s vibrant, world-renowned tourist and commercial district — under a formal service agreement, ensuring full compliance with all statutory requirements of the Hong Kong Companies Ordinance (Cap. 622)

- Register of Significant Controllers (RSC) Register of Directors

- Register of Members (Shareholders)

- Records of the Designated Representative (appointed to facilitate law enforcement access to the RSC, as required by law)

- Register of Directors

- Register of Company Secretaries

We proactively notify you of all critical compliance dates — including annual returns, tax filings, and other statutory obligations — so you never miss a deadline and remain in good standing with regulators

To get started, please review the list of available licensed money service operators below and select your 2 (two) preferred partners. Once you’ve made your choice, we’ll prepare fully tailored applications designed to maximise your approval chances with both providers. Dual banking relationships give you:

- Access to multiple underlying banking partners (such as DBS, Standard Chartered, Citibank, and others) and broader geographic coverage

- Reduced dependency on a single payment channel, significantly lowering operational risk

- More competitive fees, wider currency options, and faster settlement times

- Your clients will appreciate the multiple options

Our goal is to successfully secure multi-currency accounts with 2 two payment providers of your choice — so your business can thrive in international markets

Our Official Partners: Leading global payment providers

Other trusted, compliance-approved platforms

Already have a preferred provider outside our partner network? No problem —

we’ll fully support your account opening with the institution of your choice

Under Hong Kong law, every local limited company must submit a written notification to the Business Registration Office (BRO) within one month of the actual commencement of business. The notification must include the company’s business name, address, nature of activities, and commencement date.

We prepare and submit this mandatory IRBR200 form to the Inland Revenue Department (IRD) on your behalf. Once processed, you’ll receive an updated Business Registration Certificate (BRC) that officially reflects your declared business scope

The Census and Statistics Department (C&SD) issues a mandatory statistical survey to most registered businesses each quarter. If selected—which applies to the vast majority of active companies — you must complete and return the form within 14 days of issuance.

This report supports Hong Kong’s official economic data collection and is compulsory regardless of your company’s size, revenue, or current operational status. We monitor incoming survey notices, complete the form based on your records, and ensure timely submission

All registered employers in Hong Kong must file an annual Employer’s Return — even if they have no employees, local or overseas. The IRD issues Form BIR56A annually on 1 April, and the completed return must be submitted within one month

This includes:

- Form BIR56A (the main employer return)

- Form IR56B for every employee whose total income exceeds the threshold in Note 1(a) of the form’s instructions—regardless of whether their duties were performed in or outside Hong Kong

We manage the full preparation and filing process, including accurate reporting of international staff (e.g., assignment details, short-term visits, or remote work arrangements)

We’ll submit your application to a third leading global licensed money service operator.

If all applications are approved, you’ll have the freedom to compare, test, and focus on the providers best suited to your business needs — whether that’s lower fees, faster settlements, broader currency support, or smoother compliance and onboarding experiences

In compliance with Section 379 of the Companies Ordinance (Cap. 622), we prepare your company’s complete annual financial statements for its first financial year in accordance with Hong Kong Financial Reporting Standards (HKFRS). These statements present a true and fair view of your company’s financial position as required by law, forming the foundation for audit, tax filing, and regulatory reporting

A statutory audit conducted by a practising CPA auditor registered with the Hong Kong Institute of Certified Public Accountants (HKICPA), in compliance with Section 404 of the Companies Ordinance (Cap. 622). The audit culminates in an independent auditor’s report containing a formal opinion — required for submission to the Inland Revenue Department (IRD) following the end of your company’s first financial year

Accurate and timely preparation and submission of your BIR51 Profits Tax Return to the Inland Revenue Department (IRD), in compliance with Section 51 of the Inland Revenue Ordinance (Cap. 112) — ensuring your company meets its statutory filing obligations following the end of its first financial year

A detailed tax computation, as required under the Inland Revenue Ordinance (Cap. 112), accompanied by a formal application for profits tax exemption under Hong Kong’s territorial tax principle (Section 14). This application is submitted when your company’s profits are derived wholly outside Hong Kong, and it clearly demonstrates that your assessable profits have no Hong Kong source, thereby forming the basis for a valid and compliant claim for tax exemption

Hong Kong for international business

Profits made outside of Hong Kong are not taxed.

In Hong Kong there is a territorial principle of taxation – only profits gained from a source in Hong Kong are taxed

Outgoing dividends are not taxable.

You can pay dividends to shareholders and investors at no additional cost.

Dividends received by a Hong Kong company are also not taxable.

There is no VAT tax or its equivalent in Hong Kong.

The absence of VAT eliminates the need to increase the cost of your company’s products/services and to submit the relevant reports.

Who are looking for a favorable jurisdiction to conduct export/import activities in the international field.

For example, buying products in China and exporting to Europe (or vice versa).

Whose goal is to succeed in international trade transactions by being located in one of the world’s leading commercial centers.

For example, providing sourcing services in the U.S. for European customers (or vice versa).

A document issued by the Hong Kong Companies Registry (CR) which includes details from the Certificate of Incorporation and the company’s registered office, provides the name of director(s), the name of shareholder(s) and records the distribution of share capital among several shareholders, and contains details of the corporate secretary.

- the first business wallet in Hong Kong

- licensed by the Hong Kong Monetary Authority

- settlements with counterparties in 5 main currencies

- your company gets DBS Hong Kong bank account details

- remote account opening on your mobile

- attractive fees for SME

- the № 1 cloud-based accounting software.

- ability to integrate with bank

- 800 integrations with other banks and services

- a wide range of dashboards for company finances

- convenient accounting functionality

- automatic generation of reports

- online invoicing of counterparties

- secure database

Vita Liberta Limited is a member of the HK TCSP Professional Service Association.

This membership reaffirms our commitment to upholding the highest standards of professional conduct, ethical business practices, and ongoing professional development in the corporate services industry.

HK TCSP

HK TCSPMembership Certificate

Apply now and get a PDF file with payment options for your business in Hong Kong

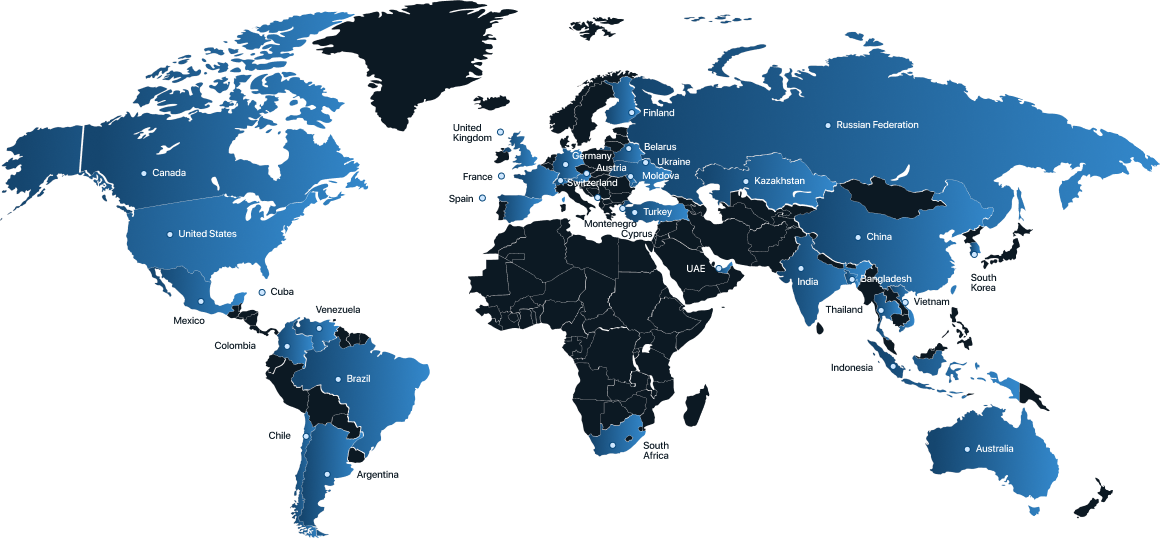

China, India, UK, France, Spain, Venezuela, USA, Switzerland, Austria, Finland, Germany, Mexico, Australia, Thailand, Cyprus, Vietnam, Bangladesh, UAE, South Korea, Indonesia, Montenegro, Argentina, Chile, Brazil, South Africa, Canada, Kazakhstan, Russia, Ukraine, Moldova, Turkey

Frequently asked questions

Business registration and account opening is done completely remotely without a visit to Hong Kong.

Yes, you can be a director and founder of the company in one person. You do not need a work permit for this.

Yes, if the source of profit of the company arises outside Hong Kong. Otherwise, the profit (income less expenses) of the company up to 2,000,000 HKD is taxed at a rate of 8.25%, and profits over 2,000,000 HKD at a rate of 16.5%.

Yes, it is possible to get an ID card which gives the right to permanently reside and work in Hong Kong. To do this, you need to provide the necessary documents and demonstrate the importance of your business for the economy of Hong Kong.

No, the People’s Republic of China and Hong Kong Special Administrative Region are not an offshore zone. Hong Kong is also not included in the list of offshore jurisdictions of the Ministry of Finance of the Russian Federation.

By paying dividends to shareholders, complying with the mechanism set out in the Hong Kong Companies Ordinance. The payment of dividends is tax-free, the frequency of payment is not limited (if the director of the company has no objections). Also, having a corporate card, you can pay the business expenses of the company.